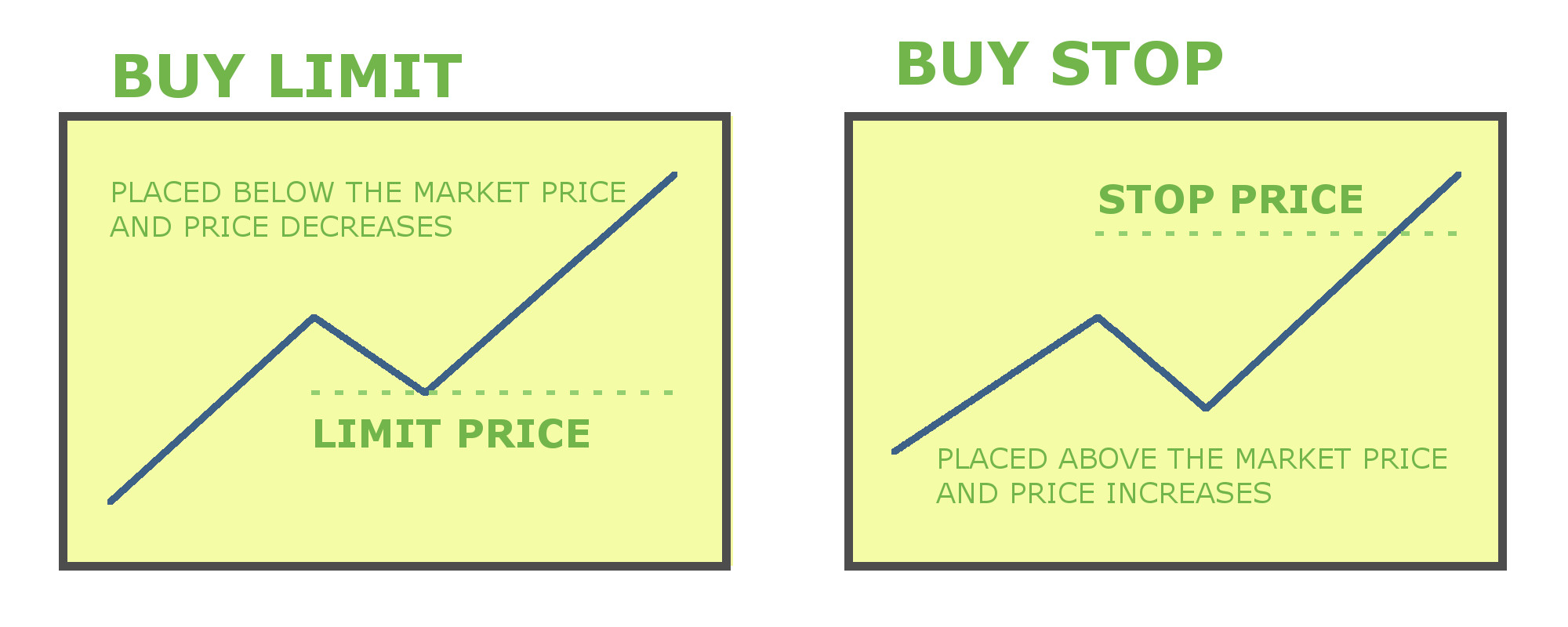

If it doesn’t trigger, it means the expected move never happened and you won’t miss out on anything. On the other hand, the stop order allows you to get in along the momentum. It may not be triggered before the market turns and makes the anticipated move, making you miss the move. The limit order gives you control of the price to get in at but there is no assurance of execution with limit orders. Which is better - stop or limit order?Ī limit order will only be filled at the specified limit price or better whereas once a stop order triggers at the specified price, it will be filled at the prevailing price in the market so that it could get filled at a worse price. When the price rises to that level, your order will be filled at $300 or higher. Similarly, if you want to sell Microsoft Corp.’s (MSFT) stock but think that its current price of $237 per share is too low and believe that it could rise to $300 per share in the coming weeks, you can set a sell limit order at $300. The order will remain open until the stock reaches the specified limit price, and your order gets filled at $130 or lower, or you cancel the order. You can set a buy limit order to purchase the stock at $130 per share, good ’til canceled. Let’s say Apple Inc’s (AAPL) stock is trading around $150 per share, and you believe it could fall to $130 in the coming days or weeks. An example of a limit order (buy and sell limit order) The order is placed below the current market price with the hope that the price will fall lower to its level and then reverse.Ī sell limit order, on the other hand, is placed above the current market price and can only be executed at the specified limit price or higher. There are two types of limit orders: the buy limit order and the sell limit order.Ī buy limit order is an order to buy a security at the specified limit price or lower.

Types of limit orders: buy limit order and sell limit order It is also important to note that for many brokers, a limit order is usually valid for a specific number of days until the order is filled or until the trader cancels the order. While a limit order may be appropriate when you think you can get in at a better price, you may end up missing the trade entirely. However, there is no assurance of its execution, as the price might not get to the specified price, resulting in missed trading opportunities. So, it gives the trader more control of the price they get in at. When the order is filled, it will only be at the specified limit price or a better price. The limit order is usually placed away from the current market price, and it sits there waiting for the price to reach the specified level. It comes with a specification of the maximum price to be paid or the minimum price to be received, and this is known as the “limit price”. What is the disadvantage of a limit order strategy?Ī limit order is an order to buy or sell a security at a specific price or better.What is the benefit of using limit orders?.Limit order strategy backtest – does it work?.

An example of a limit order (buy and sell limit order).Types of limit orders: buy limit order and sell limit order.

The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. There are no guarantees that working with an adviser will yield positive returns. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). All investing involves risk, including loss of principal. This is not an offer to buy or sell any security or interest. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. SmartAsset’s services are limited to referring users to third party registered investment advisers and/or investment adviser representatives (“RIA/IARs”) that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Securities and Exchange Commission as an investment adviser. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S.

0 kommentar(er)

0 kommentar(er)